“The people's money for people's welfare”

On 1st of September, 1956, the Life Insurance Corporation of India (LIC) embarked on its momentous journey in true spirit of serving the people and nation as a whole. Since then it has spearheaded the financial and infrastructure development of the nation.

The performance of LIC has been exemplary and it has been growing from strength to strength; be its customer base, agency network, branch office network and the likes. LIC has played a significant role in spreading life insurance among the general masses and mobilization of people’s money for people’s welfare. Even after the entry of private insurers for almost decade now, Life Insurance Corporation of India continues to be the front runner in the industry in terms of market share, which is a result of the age old trust and respect, LIC has earned in the hearts of the countrymen.

The Corporation has made an oustanding contribution towards national growth and social upliftment. The major portion of the Corporation's fund is invested for the welfare of ther masses. As on 31st March, 2010 LIC has provisionally invested Rs. 11,00,000 crores of its fund in various social welfare drives of the nation.

TARGET:

- Mobilisation of People's money

- Investment of Insurance fund for the Benefit of society at a large.

URGE FOR NATIONALISATION OF INSURANCE COMPANIES:

Post Independence India was going through various socio-economic turmoils. The need of the hour, to hold the nation from falling apart was promptly identified by Pt. Nehru, and the National Congress Party. It was- Nationalisation of Insurance Companies. The urge for this nationalisation drive was realised primarily because of the factors as-

- Independent India needed mass Infrastructural development.

- Huge Capital was required.

- Implementation of Five Years Planning, became a necessity.

- Requirement of huge Long Term Fund.

- Insurance Money was a source of Long Term Fund.

- Ordinance passed in the Parliament.

- 245 Private insurance Companies were amalgamated to form the Life Insurance Corporation of India

|

| T.S Vijayan - Ex-Chairman (Currently Chairman, IRDA) |

LIC’s STRENGTH

- Total Work force- More than 1 lakh

- Agency force of 14 lakh.

- 27 crore Policy holders.

- 3000 offices in India.

- Overseas operation in Fiji, Mauritius, UK, Singapore, Bahrain,Nepal,Srilanka and Kenya.

- Revenue earned in 2009-10- Rs.2.98 lakh crore.

- Total Life Find Rs. 9.99 lakh crore.

- LIC’s contribution - 3.2% to India’s total GDP.

- Total investment- Rs. 10.95 lakh crore.

- Contribution to Five Years Plans - Rs.10.32 lakh crore.

- LIC is the Single largest Secondary market Investor by investing 15% of its funds invested in share.

- Largest Pension Player in the country.

ROLE OF LIC IN NATIONAL ECONOMY:

LIC has been a nation builder since it’s formation in 1956.Accumulating people’s money and investing it for development of the society -“people’s money for people’s welfare” was the prime objective of why the Corporation came into being.

LIC’s contributions:

- 3.2% of India’s total GDP (Total Insurance Penetration is 4.17%)

- Total investment Rs. 10.95 lakh crore in 2009-10

- Total investment in five years plans Rs. 10.32 lakh cr.

- As on 31.03.2010 LIC is only largest Single Investor in equity by investing, only 15% of it’s investable fund.

INVESTMENT OF CORPORATION’S FUND:

Investment of LIC’s fund is governed by Section 27A of Insurance Act,1938. Guidelines and instructions are often changed from time to time by the Govt. keeping in view the best interest of the nation. Now investment is also regulated by the IRDA- the Insurance Regulatory arm of the Reserve Bank of India.

Investment Pattern for Life Business:

- Govt. Securities - 25%

- Govt. Securities or other approved Securities including above- Not less than 50%

- Infrastructure and Social Sector- Not less than 15%

- Others beside unapproved investments "in no case to exceed 15% of the fund” - Not Exceeding 35% ( To be governed by exposer norms)

Investment Pattern for Pension,Annuity and other Group Business :

- Investment in Govt Securities -Not less than 20%

- Investment in Govt. Securities and other approved securities including above - Not less than 40%

- Balance to be invested as per Schedule I to be governed by prudential norms – Not exceeding 60%

Investment Pattern for Linked Business:

- Largely pattern of investment decided by the policy holders in categories of assets which are easily marketable and realisable(like Bond,Secured,Growth and Balance fund)

- Total investment in unapproved category shall not exceed 25% of fund.

TOTAL INVESTMENT AS ON 31.03.2010 : Rs. 10,95,841.34 crores

- Rs. 10,06,091.93 crore in Securities (91.81%).

- Govt.Securities Rs. 8,04,087 crore and balance in other Approved Securities.

- Rs. 85,256.46 crore in loans(7.78%).

- Others Rs. 4,492.95 crore (0.41%).

LIC’S SOCIAL RESPONSIBILITY:

- LIC paid Rs. 252.71 crore for 94.464 Claims under Social Security Scheme 2009-10.

- Rs. 93.05 crore paid as Scholarships to needy students.

- 2.99 crore Lives given insurance under Social Security Scheme (SSS).

Glimpses of LIC's Performance:

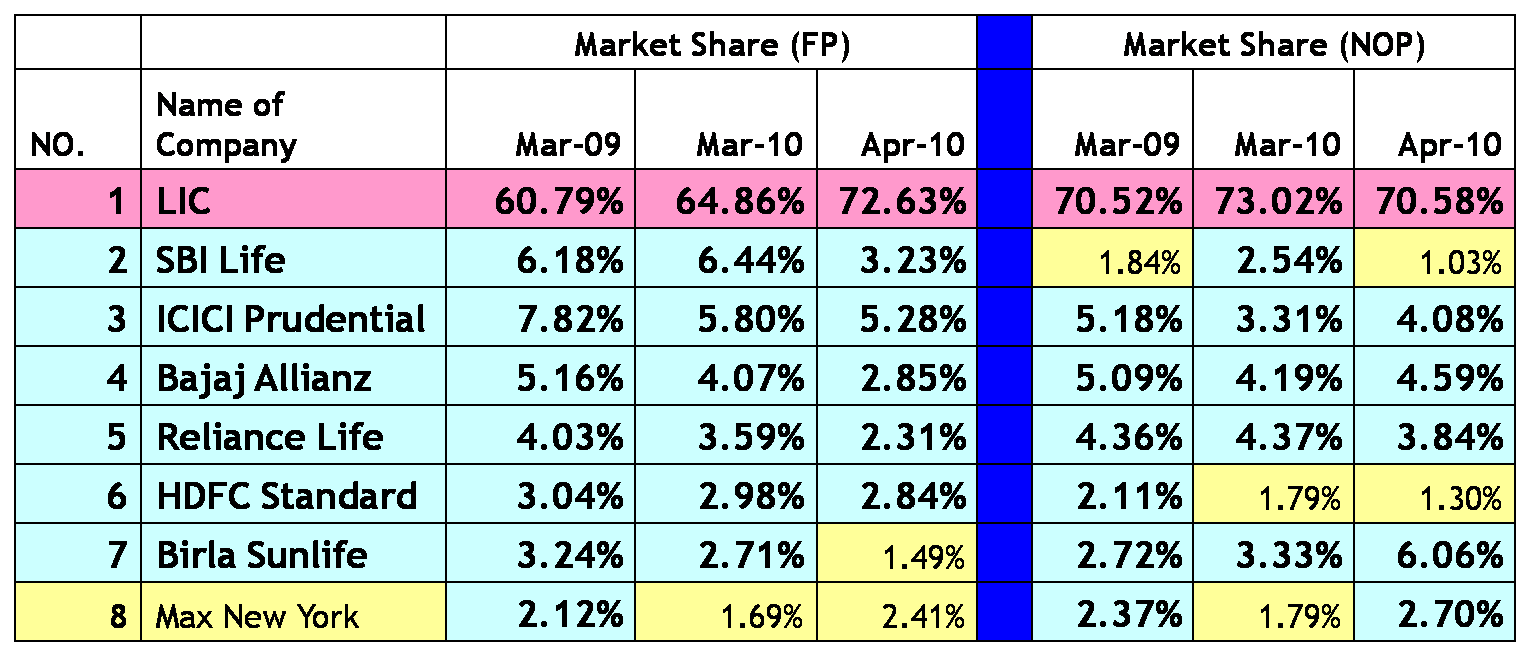

- MARKET SHARES OF THE FRONT RUNNERS IN LIFE INSURANCE

- A Comparative Analysis ***FP= First Premium,NOP= No. of Policies

- NEW BUSINESS DURING THE YEAR 2009-10:

NOP* (in lacs)

|

FPR** (in crores)

| |

COMPOSITE

|

388.39

|

42960.44

|

MARKET SHARE

|

100%

|

84.86%

|

*NOP- No. of policies **FPR- First Revenue Income

- PENSION & GROUP BUSINESS & SOCIAL SECURITY SCHEMES (Achievement from 1.4.2009 to 31.8.2010):

| Pension & Group Schemes | Growth Rate (%) |

Social Security Schemes | |

| NEW LIVES (in lacs) | 237.57 | 15% | 149.76 |

| PREMIUM INCOME(in crores) | 20831.94 | 67% | 228.70 |

No comments :

Post a Comment