MEMBERS OF THE BOARD

- Mr. D.K Meherotra- Chairman

- Mr. T.S Vijayan M.D-

- Mr. Thomas Mathew T. - M.D

- Mr. A.K Dasgupta - M.D

- Mr. Ashok Chawla- Member of the Board

- Mr. R. Gopalan - Member of the Board

- Mr. Yogesh Lohia - Member of the Board

- Mr. D.L Rawal - Member of the Board

- Mr. Monish R. Kidwai - Member of the Board

- Dr. Sooranad Rajashekhran - Member of the Board

- Lt. Gen. Arvind Mahajan - Member of the Board

- Mr. Anup P. Garg - Member of the Board

- Total Work force- More than 1 lakh

- Agency force of 14 lakh.

- 27 crore Policy holders.

- 3000 offices in India.

- Overseas operation in Fiji, Mauritius, UK, Singapore, Bahrain,Nepal,Srilanka and Kenya.

- Revenue earned in 2009-10-

2.98 lakh crore.

2.98 lakh crore. - Total Life Find

9.99 lakh crore.

9.99 lakh crore.

- LIC’s contribution - 3.2% to India’s total GDP.

- Total investment-

10.95 lakh crore.

10.95 lakh crore. - Contribution to Five Years Plans -

10.32 lakh crore.

10.32 lakh crore. - LIC is the Single largest Secondary market Investor by investing 15% of its funds invested in share.

- Largest Pension Player in the country.

LIC has been a nation builder since it’s formation in 1956.Accumulating people’s money and investing it for development of the society -“people’s money for people’s welfare” was the prime objective of why the Corporation came into being.

LIC’s contributions:

- 3.2% of India’s total GDP (Total Insurance Penetration is 4.17%)

- Total investment

10.95 lakh crore in 2009-10

10.95 lakh crore in 2009-10 - Total investment in five years plans

10.32 lakh cr.

10.32 lakh cr. - As on 31.03.2010 LIC is only largest Single Investor in equity by investing, only 15% of it’s investable fund.

INVESTMENT OF CORPORATION’S FUND:

Investment of LIC’s fund is governed by Section 27A of Insurance Act,1938. Guidelines and instructions are often changed from time to time by the Govt. keeping in view the best interest of the nation. Now investment is also regulated by the IRDA- the Insurance Regulatory arm of the Reserve Bank of India.

Investment Pattern for Life Business:

- Govt. Securities - 25%

- Govt. Securities or other approved Securities including above- Not less than 50%

- Infrastructure and Social Sector- Not less than 15%

- Others beside unapproved investments "in no case to exceed 15% of the fund” - Not Exceeding 35% ( To be governed by exposer norms)

Investment Pattern for Pension,Annuity and other Group Business :

- Investment in Govt Securities -Not less than 20%

- Investment in Govt. Securities and other approved securities including above - Not less than 40%

- Balance to be invested as per Schedule I to be governed by prudential norms – Not exceeding 60%

Investment Pattern for Linked Business:

- Largely pattern of investment decided by the policy holders in categories of assets which are easily marketable and realisable(like Bond,Secured,Growth and Balance fund)

- Total investment in unapproved category shall not exceed 25% of fund.

TOTAL INVESTMENT AS ON 31.03.2010 :  10,95,841.34 crores

10,95,841.34 crores

10,06,091.93 crore in Securities (91.81%).

10,06,091.93 crore in Securities (91.81%).- Govt.Securities

8,04,087 crore and balance in other Approved Securities.

8,04,087 crore and balance in other Approved Securities.  85,256.46 crore in loans(7.78%).

85,256.46 crore in loans(7.78%).- Others

4,492.95 crore (0.41%).

4,492.95 crore (0.41%).

LIC’S SOCIAL RESPONSIBILITY:

- LIC paid

252.71 crore for 94.464 Claims under Social Security Scheme 2009-10.

252.71 crore for 94.464 Claims under Social Security Scheme 2009-10.  93.05 crore paid as Scholarships to needy students.

93.05 crore paid as Scholarships to needy students.- 2.99 crore Lives given insurance under Social Security Scheme (SSS).

Glimpses of LIC's Performance:

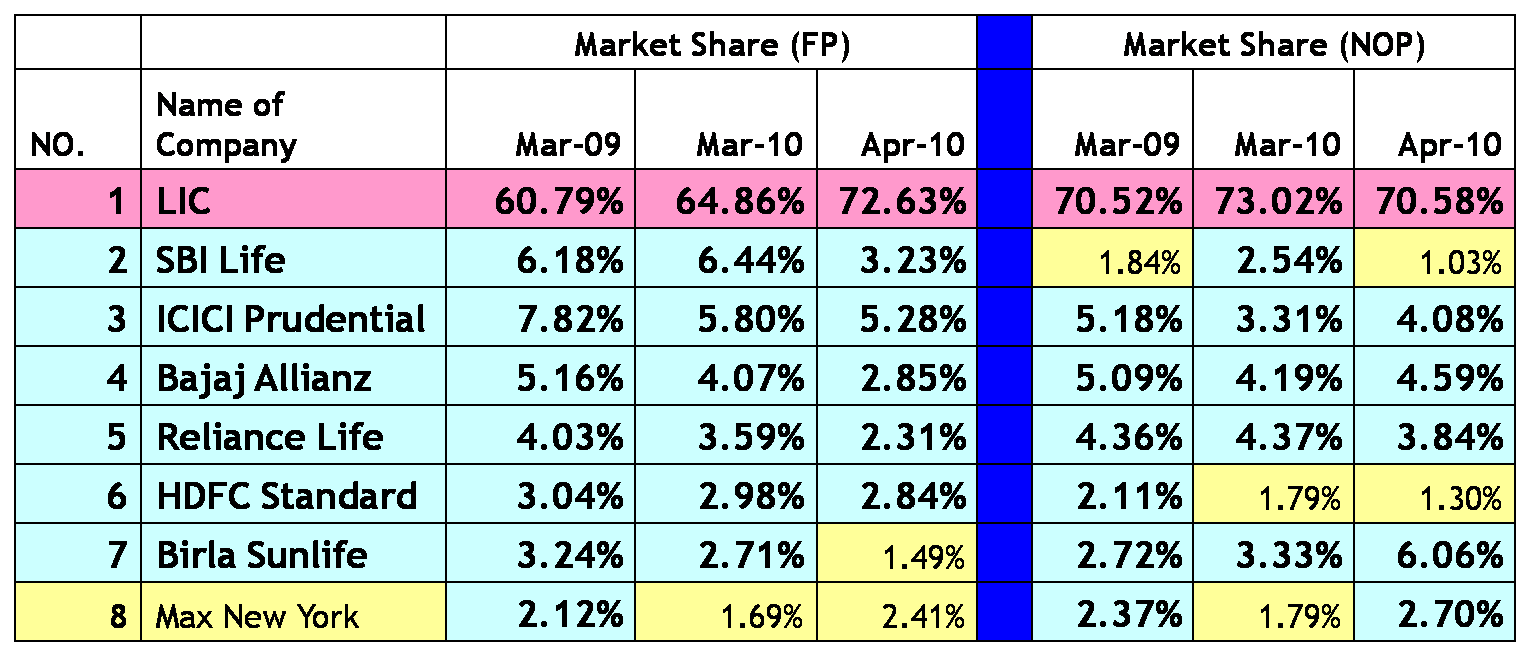

***FP= First Premium,NOP= No. of Policies

- NEW BUSINESS DURING THE YEAR 2009-10:

| NOP* (in lacs) | FPR** (in crores) | |

| COMPOSITE | 388.39 | 42960.44 |

| MARKET SHARE | 100% | 84.86% |

- PENSION & GROUP BUSINESS & SOCIAL SECURITY SCHEMES (Achievement from 1.4.2009 to 31.8.2010):

| Pension & Group Schemes | Growth Rate (%) |

Social Security Schemes | |

| NEW LIVES (in lacs) | 237.57 | 15% | 149.76 |

| PREMIUM INCOME(in crores) | 20831.94 | 67% | 228.70 |

No comments :

Post a Comment